TRACK RECORD

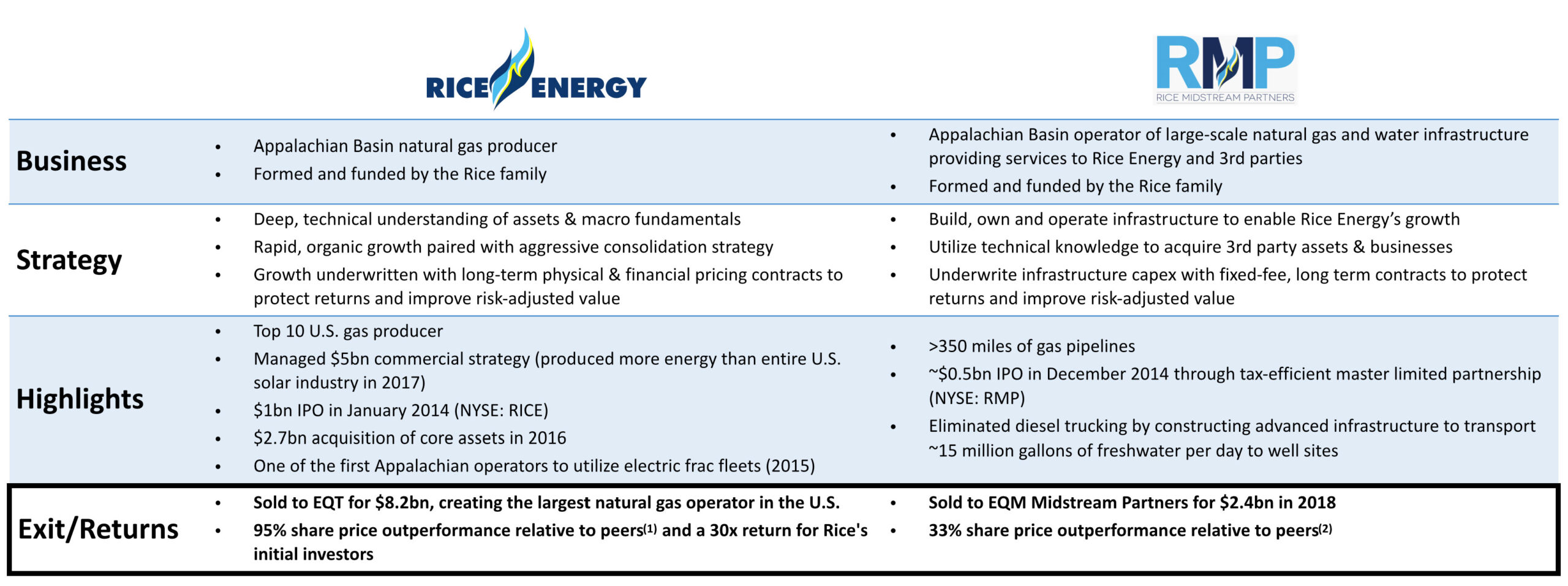

Rice: $10 Billion Energy Enterprise, Built from Scratch

- Accretive growth from 2008 startup to top ten US gas producer by 2017 with a strategy underpinned by technical acumen + long-term focus

- Rice and peers’ clean-burning natural gas were the driving forces behind the declines in US coal consumption and US CO2 emissions

1 Peers include AR, CNX, COG, EQT, GPOR, and RRC. Performance period measured from 1/24/14 (RICE IPO) to 11/13/17 (closing of RICE/EQT acquisition).

2 Peers include AM, CNXM, EQM. Performance period measured from 12/17/14 (RMP IPO) to 11/13/17 (closing of RICE/EQT acquisition).

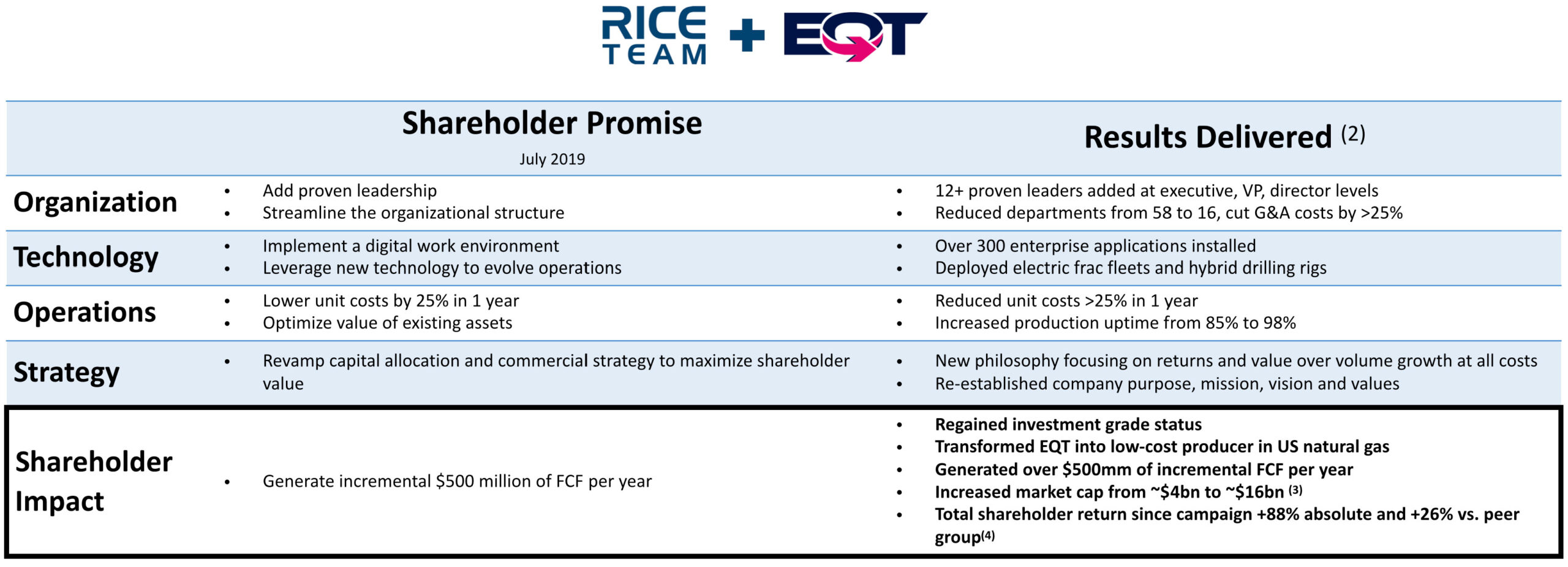

EQT: Rice Team Helped Transform Into Sector-Defining Natural Gas Producer in North America

- Following EQT’s $8.2bn acquisition of Rice Energy, EQT struggled to deliver the benefits of the merger and was plagued by poor operational performance and disappointing shareholder returns

- In response to inquiries from other shareholders, the Rice Team(1) conducted a shareholder campaign to revamp the strategic direction of EQT

- In July 2019, >80% of shareholders elected the Rice Team director nominees, replacing a majority of EQT’s board and executive team, and inserted Toby Rice as CEO

- In 18 months, The Rice Team transformed EQT from a 2,000-person siloed organization into a modern, digitally enabled, natural gas powerhouse

1 The Rice Team was comprised of Toby Z. Rice, Derek Rice, Kyle Derham and Will Jordan. Daniel Rice was a Rice Team director candidate. Following the campaign, Toby Rice joined the company as President and CEO and Danny continued his role on the Board. Kyle Derham served as interim CFO and strategic advisor. Derek Rice and Jamie Rogers served as consultants during the turnaround efforts.

2 Performance metrics per EQT 2Q20 Investor Presentation.

3 As of 12/31/23, per Bloomberg.

4 Peers include AR, CNX, CTRA, RRC and SWN. Performance period measured from 12/7/18 (trading date prior to the Rice Team sending its first public letter to EQT’s board) to 12/31/23. Trading data per Factset.

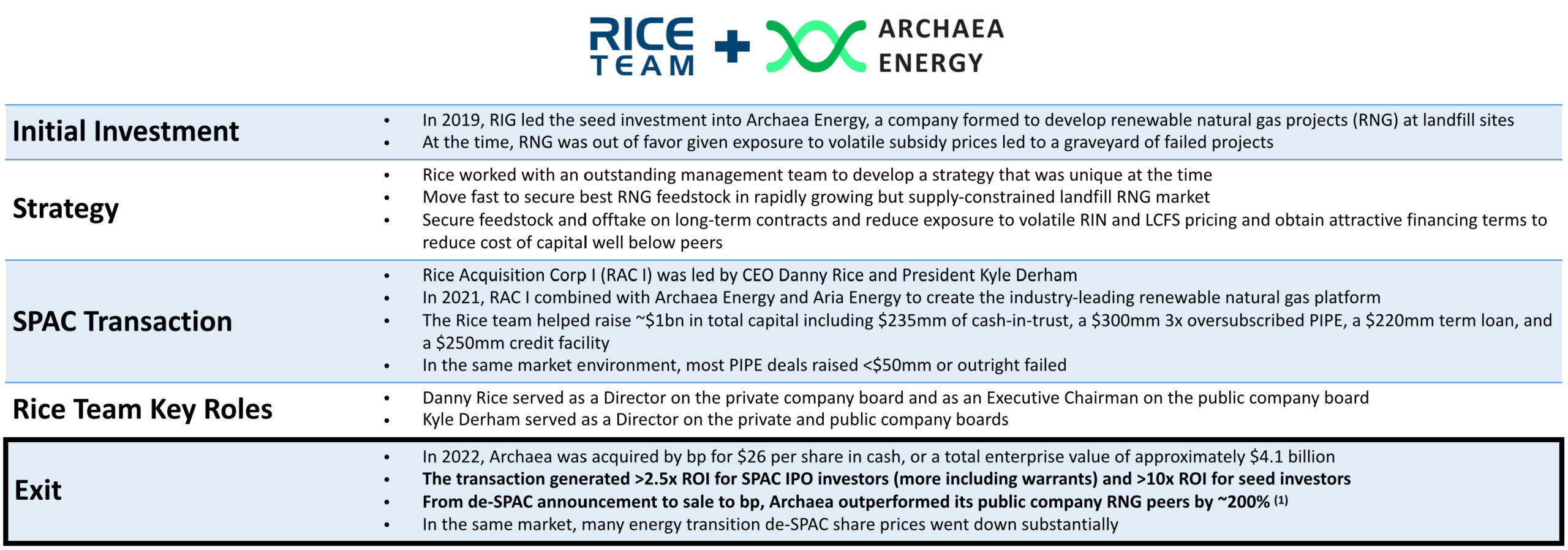

Archaea Energy: Rice Team Helped Fund and Scale the Sector-Defining Renewable Natural Gas Producer

- The Rice team led the seed investment and later structured the SPAC transaction that helped fund Archaea Energy, combine it with Aria Energy, and propel it from an idea to a $4bn exit

- At the board level, Rice helped guide strategy, M&A, public company operations, and an eventual exit to bp (NYSE: BP)

1 Peers include AMTX, CLNE and MNTK. Performance period measured from 4/6/21 (trading date prior to announcement of de-SPAC transaction) to 11/25/22.

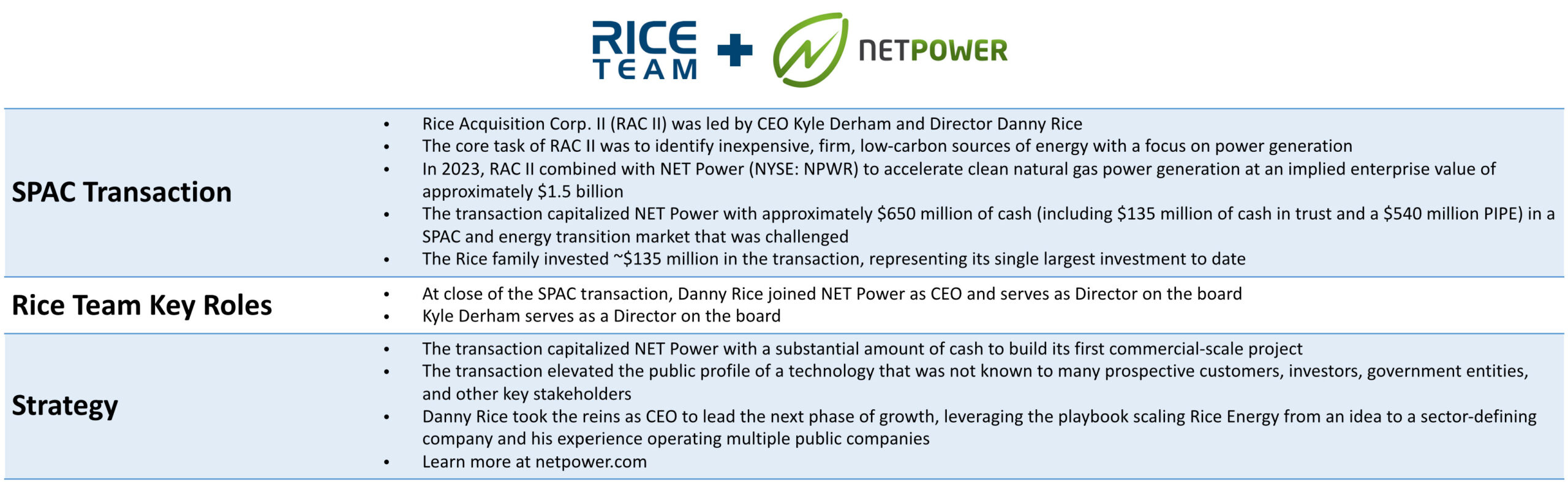

NET Power: Rice Team Helps Capitalize and Accelerate Clean Natural Gas Power Generation

- The Rice team sponsored a second SPAC that was tasked with identifying the best source of carbon free, firm energy

- After an exhaustive search, Rice identified NET Power, invested ~$135 million of family capital, and Danny Rice took the reins as CEO to lead the next phase of growth